Introduction

India’s FMCG delivery ecosystem is going through a major transition. Traditional kirana stores, which have been the last-mile backbone for decades, now co-exist with e-commerce marketplaces, modern trade, and quick-commerce platforms.

In this blog, we will explore why this shift is happening, which models are working, what it means for brands like Priniti Foods and distributors, and how the landscape is expected to look over the next 2–3 years.

Priniti Foods Snapshot: Then vs. Now

Then (Kirana-led):

- Flow: Distributor → Wholesaler → Retailer (Kirana) → Consumer

- System: Cash-and-carry, credit-based sales, limited SKUs, and localized assortment.

- Earlier, Priniti Foods’ snacks and namkeen were sold primarily through kirana stores.

Now (Omnichannel – but partner-driven):

- Priniti Foods does not operate its own direct online marketing or D2C channel.

- However, its products are now available across Traditional Trade (kirana & GT), Modern Trade (large retail stores), and Marketplaces (online platform tie-ups).

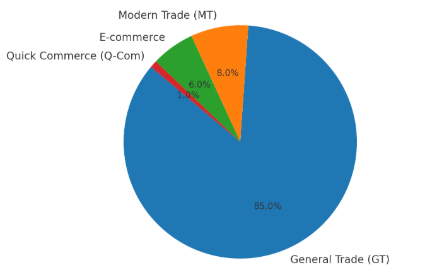

FMCG Channel Store 2019-2020

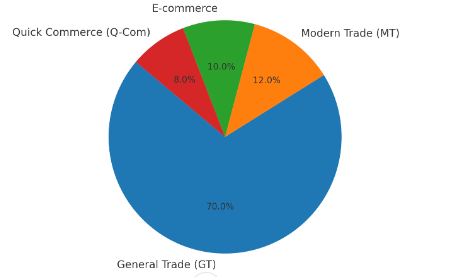

FMCG Channel Store 2024-2025

- Result: Consumers enjoy faster fulfilment and greater variety, but service costs and supply-chain complexity for brands and distributors have increased.

Why the Shift Happened for Priniti Foods

- Consumer Expectations: Today’s buyers demand convenience, speed, and flexible payment options. Even Tier-2/3 city customers, who are mobile-first, prefer branded snacks. Priniti Foods caters to both taste and affordability with its wide range of snacks.

- Smartphone & UPI Penetration: With shopping and payments shifting online, Priniti Foods’ products have become more discoverable on marketplaces and modern trade platforms.

- Urban Demand: High-frequency snack SKUs (like chips and namkeen) are seeing rapid growth in urban areas. Priniti Foods leverages its distributor and retail partner network to serve this demand.

Conclusion

India’s FMCG delivery landscape is now omnichannel—where kirana, marketplaces, modern trade, and quick-commerce each bring unique strengths. For brands, the question is not “either/or” but “and.” Success depends on the right portfolio, right channel, at the right time.

In this transformation, brands like Priniti Foods are aligning their distribution playbooks with evolving consumer missions—whether it’s the kirana shelf, a quick-commerce basket, or a modern trade promotion box.

FAQ

Q1. Will quick commerce replace kirana stores?

No. Kirana stores will remain the backbone of FMCG delivery, especially for everyday consumption. Quick Commerce primarily captures impulse buys and emergency snacking needs. For Priniti Foods, both channels are important—kirana ensures depth of reach, while Q-Com drives trial and speed-led visibility.

Q2. What tarting channel for a snack brand like Priniti Foods?

For Priniti Foods, Quick Commerce and Marketplaces are the best pilot channels to launch new flavours or limited-time snacks and test consumer demand. Once performance is proven, products are rolled out at scale in General Trade (kirana network) and Modern Trade stores.

Q3. How can Priniti Foods improve unit economics across channels?

By focusing on:

- Assortment strategy: Right SKUs by channel (e.g., gifting packs for Modern Trade, trial packs for Q-Com).

- AOV engineering: Bundling multipacks to increase basket size.

- ROI-driven placements: Investing in in-app visibility and promotions where returns are measurable.

- Efficient logistics & distributor SLAs: Ensuring freshness

Q4. What are the disadvantages of Quick Commerce for consumers?

- Higher product prices – Extra delivery charges, platform fees, and markups make items costlier than kirana or supermarkets.

- Hidden costs – Small order surcharges and packaging charges increase overall spend.

- Limited discounts – Fewer promotions compared to kirana bulk buying or modern trade offers

- Smaller pack sizes – Mostly trial or single-serve packs; family value packs often missing.

- Indirect impact of brand margins – Platforms take high commissions, so brands earn less margin, which indirectly leads to higher consumer prices and fewer offers.