Introduction

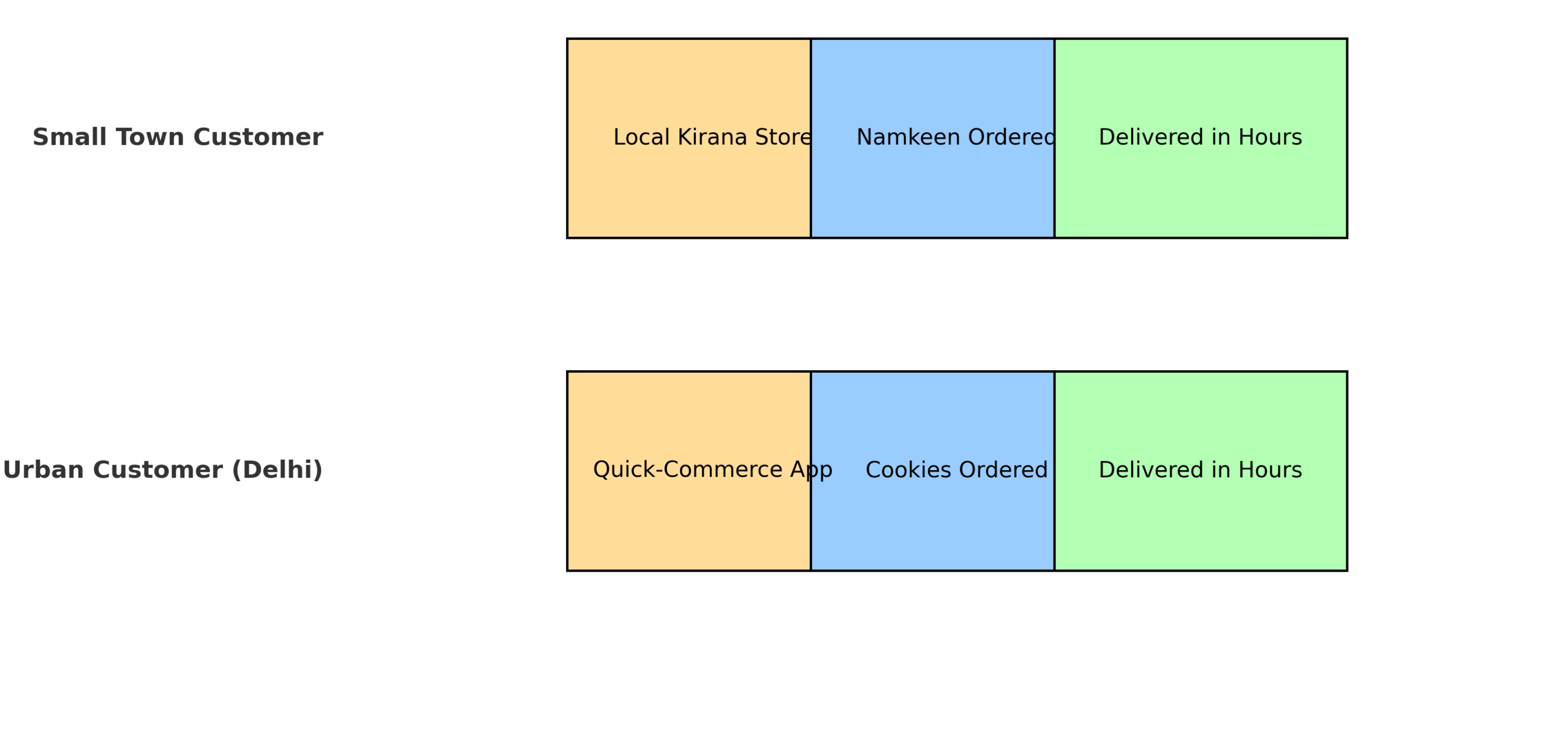

A family in a small town orders their favorite pack of namkeen from the local kirana, while a young professional in Delhi adds cookies to his quick-commerce cart during a coffee break. Within hours, both expect their products to arrive — fresh, affordable, and on time. This is the promise of India’s Fast-Moving Consumer Goods (FMCG) sector — an industry that continues to expand rapidly and touch millions of lives every single day. With its footprint spanning from bustling metros to the most remote villages, FMCG Companies has become the true heartbeat of India’s consumer market.

Last-Mile Delivery Journey : Small Town vs. Urban Customer

However, behind this convenience lies a constant struggle: the chaos of last-mile delivery. The final step of moving goods from distribution hubs to kirana stores or directly to customers’ doorsteps is often the most unpredictable and costly.

In a country with numerous kirana shops, extensive rural areas, and increasingly congested city roads, FMCG Companies brands must innovate to keep shelves stocked and customers satisfied. Leaders like Priniti Foods, ITC, Britannia, Nestlé, and HUL are rewriting supply chain playbooks with technology, digitization, and sustainable delivery models. This blog explores how these companies are turning last-mile challenges into opportunities, ensuring that the snacks, groceries, and essentials consumers love never stay out of reach.

What is Last-Mile Delivery for FMCG Companies?

Last-mile delivery is the final and most critical stage of product distribution. It determines how quickly and efficiently goods reach the end consumer or retail partner.

For FMCG companies, this step is crucial because:

- Products have low margins but high volume, making logistics efficiency essential.

- Delays or disruptions lead to empty shelves, directly impacting consumer trust and sales.

- Rising expectations from consumers (like 10-minute delivery services) are pushing FMCG brands to rethink strategies.

Why Last-Mile Delivery is Challenging in India

- Geographic Diversity

India’s urban-rural divide creates complex delivery routes. While metropolitan areas demand speed and convenience, rural areas face accessibility challenges. - Traffic Congestion & Poor Infrastructure

Urban hubs like Delhi, Mumbai, and Bengaluru face heavy traffic, while rural roads remain underdeveloped. This slows down the supply chain. - High Cost of Logistics

India spends nearly 14% of its GDP on logistics, which is significantly higher than in developed nations. For FMCG, this is a direct burden due to thin margins. - Fragmented Retail Market

Over 90% of India’s retail is unorganized, with millions of kirana shops spread across the nation. Reaching all of them efficiently is a challenge. - Evolving Consumer Expectations

E-commerce and quick commerce (Zepto, Blinkit, Swiggy, Instamart) have set new standards. Consumers now expect FMCG deliveries in hours instead of days.

How Indian FMCG Companies Are Tackling Last-Mile Chaos

1. Leveraging Technology & Data Analytics

Technology is at the heart of efficient last-mile delivery. FMCG players use AI, machine learning, and data analytics to reduce inefficiencies.

- Route optimization ensures deliveries avoid congested routes.

- Predictive analytics forecast demand trends, ensuring the right stock in local warehouses.

- Real-time tracking systems provide visibility to both companies and consumers.

2. Partnering with Hyperlocal & Logistics Startups

FMCG companies are joining hands with delivery platforms like Delhivery, Shadowfax, Dunzo, and XpressBees.

- Hyperlocal players already have delivery fleets and digital systems, reducing investment needs.

- This speeds up urban and semi-urban deliveries significantly.

3. Direct-to-Consumer (D2C) Channels

The rise of D2C platforms has been a game-changer. FMCG companies now sell directly via their websites and mobile apps.

- Cuts dependency on traditional distributors.

- Provides valuable consumer behavior data.

- Enables faster and more personalized deliveries.

4. Dark Stores & Micro-Warehousing

Dark stores are local fulfillment centers designed for faster dispatch. FMCG brands are setting these up in urban areas.

- Reduce delivery time from days to hours.

- Improve inventory efficiency.

- Support quick commerce models.

5. Kirana Store Digitization

India’s kirana stores account for over 80% of FMCG sales. FMCG players are digitizing kiranas by providing:

- Ordering apps and digital platforms.

- QR code-based payment and stock management.

- Local fulfillment roles in last-mile delivery.

6. Sustainability in Last-Mile Logistics

Sustainability is now part of logistics planning. FMCG companies are adopting:

- EV fleets and bicycles for urban deliveries.

- Eco-friendly packaging to reduce environmental impact.

- Optimized routes to reduce fuel usage.

7. Expanding Rural Supply Chains

With rural India contributing 35% of FMCG revenue, reaching these markets is a top priority.

- Hub-and-spoke models help centralize rural distribution.

- Companies train local entrepreneurs to act as last-mile partners.

Benefits of Improved Last-Mile Delivery

- Faster access → Customers receive products on time.

- Lower costs → Optimized routes and partnerships reduce expenses.

- Wider reach → Better access to Tier-3 cities and rural India.

- Retailer satisfaction → Kiranas get consistent supplies.

- Competitive edge → Companies like Priniti Foods gain an advantage by being reliable and quick.

The Future of Last-Mile Delivery in FMCG

- Quick Commerce – 10-minute delivery services will influence FMCG strategies.

- Drone Deliveries – Especially useful in semi-urban and rural regions.

- AI & Robotics – Automated warehouses and AI-driven demand forecasting.

- Sustainability – EV fleets and recyclable packaging.

- Digitized Kirana Networks – Acting as local warehouses for FMCG products.

Conclusion

The chaos of last-mile delivery remains one of the biggest hurdles in FMCG logistics, but companies are evolving. By embracing technology, digitization, partnerships, and sustainable logistics, FMCG brands like Priniti Foods, ITC, Britannia, and HUL are building a stronger, faster, and more resilient supply chain.

As consumer expectations grow sharper and competition intensifies, Indian FMCG companies will continue investing in last-mile innovations to deliver speed, reliability, and convenience.

FAQs

Q1. What is last-mile delivery in FMCG?

It’s the final step of the supply chain where products move from local hubs to the retailer or end consumer.

Q2. Why is last-mile delivery so complex in India?

Because of traffic congestion, rural accessibility issues, high costs, and fragmented retail markets.

Q3. How is Priniti Foods tackling last-mile delivery?

Priniti Foods uses technology, micro-warehouses, D2C channels, and kirana digitization to ensure faster and cost-efficient deliveries across India.

Q4. What role do kirana stores play in FMCG delivery?

Kirana stores act as local fulfillment centers, enabling faster replenishment of products in every neighborhood.

Q5. What are some innovative models used by FMCG companies?

- Dark stores for faster dispatch.

- EV fleets for sustainability.

- Hyperlocal delivery partnerships for speed.

Q6. What is the role of quick commerce in last-mile FMCG delivery?

Quick commerce platforms like Zepto, Blinkit, and Instamart are setting delivery benchmarks that FMCG brands must adapt to.

Q7. What’s the future of FMCG logistics in India?

The future lies in AI-driven forecasting, drone-based deliveries, sustainable fleets, and fully digitized kirana networks.