The start of a new calendar year is when most distributors reset targets, renegotiate portfolios, and plan investments for the next 12 months. New Year Opportunities for FMCG Distributors are especially strong in India, where the sector is expanding both in value and volume. Priniti Foods positions its partners to use this planning window to grow volumes, improve route efficiency, and build a stronger, data-led product basket.

India’s FMCG market was valued at about ₹17.43 lakh crore in 2023 and is projected to reach around ₹73.37 lakh crore (approx.) by 2032, growing at a CAGR of about 17%. Industry tracking also indicates value growth of roughly 6% in 2024, supported by similar volume growth, showing that underlying consumption remains resilient. For serious planners, Opportunities for FMCG Distributors are not just ideas—they are backed by numbers.

1. Reading the market data behind Opportunities for FMCG Distributors

Recent estimates suggest that India’s FMCG revenue crossed ₹20 lakh crore in 2024, with urban markets contributing around 62% and rural markets about 38% of sales. Within this, the snacks segment alone reached about ₹46,571 crore in 2024 and is projected to reach roughly ₹1,01,811 crore by 2033, at an expected CAGR of around 8.6%.

For new Opportunities for FMCG Distributors, this clearly highlights that snacking is a high-rotation, repeat-purchase category. It gives distributors room to plan stable secondary sales, tighter working capital cycles, and predictable stock turns, instead of depending only on seasonal or slow-moving categories.

2. Category growth: why snacks matter for distributor profitability

Industry analysis indicates that the namkeen and savoury snacks market in India is expected to grow by about ₹37,350 crore (approx.) between 2024 and 2029, at an approximate CAGR of 10.2%. A wider global perspective shows that the worldwide snacks market was valued at roughly ₹5.23 lakh crore (approx.) in 2024, projected to move towards ₹7.80 lakh crore (approx.) by 2034, with growth of around 4% per year.

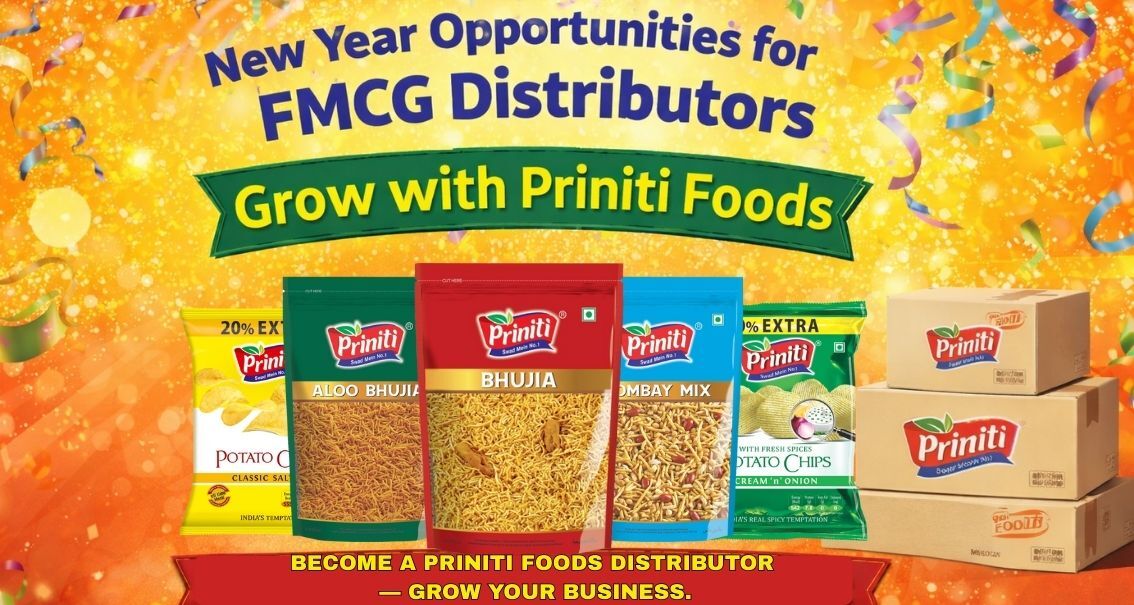

In this context, Opportunities for FMCG Distributors lie in building a basket that is heavily indexed towards everyday snacking. Priniti Foods operates in core snacking segments such as namkeens, bhujia, extruded snacks and flavoured puffs and fryums—products that fit daily home consumption, festive gatherings, workplace snacking and on-the-go purchases.

3. Regional and channel trends shaping New Opportunities for FMCG Distributors

Data suggests that general trade still accounts for about 80–85% of FMCG sales in India, while modern trade contributes roughly 12–15%, and continues to grow its share. At the same time, research by leading consulting firms shows that nearly 600 tier-2 and tier-3 cities already contribute around 36% of India’s FMCG consumption, with their share expected to move towards 45%.

These patterns make Opportunities for FMCG Distributors very clear: the next wave of growth is coming from smaller cities and developing urban clusters. For Priniti Foods partners, this translates into:

- Strengthening sub-stockist networks in tier-2 and tier-3 locations

- Deepening presence in existing towns rather than only chasing new towns

- Balancing focus between traditional kirana stores, wholesalers, and newer formats

With about 12 million retail outlets and nearly one million wholesalers and distributors in India, the ecosystem is dense and competitive. A structured New Year plan helps distributors defend and grow their numeric share in this environment.

4. Turning data into practical New Year plans with Priniti Foods

The real value of New Year Opportunities for FMCG Distributors is realised when numbers translate into clear, measurable actions. With Priniti Foods, distributors can use category data to:

- Prioritise high-rotation Priniti SKUs in namkeens and savoury snacks

- Design town-class wise assortment (metro, tier-1, tier-2, tier-3)

- Decide which grammages and price points should dominate each beat

- Allocate display investments and retailer schemes to the top outlets in each market

Instead of generic resolutions like “increase sales this year”, distributors can convert Opportunities for FMCG Distributors into specific objectives such as outlet activation targets, range depth per outlet, and contribution of Priniti Foods cartons to monthly primary billing. This creates a performance culture linked directly to field execution.

5. How Priniti Foods supports Opportunities for FMCG Distributors

The Opportunities for FMCG Distributors to be sustainable, the principal must support on product, planning, and execution. Priniti Foods works with partners to:

- Align range planning with local taste profiles and outlet type

- Support demand estimation for New Year, winter and festive periods

- Set network-wise service norms so that key SKUs remain available at the shelf

- Offer structured schemes and visibility plans that are simple to execute at market level

FAQs

1. Why should distributors focus on snacks while planning New Year targets?

Snacks and savoury products record faster rotation and frequent reorders, which helps improve cash flow and warehouse utilisation. Prioritising high-movement snacking SKUs enables more predictable secondary sales and better working capital efficiency throughout the year.

2. How can a distributor use market data in everyday decision-making?

By tracking indicators such as town-wise sales, outlet coverage, top-selling SKUs, and lines per bill, distributors can identify where demand is strengthening. Reviewing this data monthly helps decide which Priniti Foods products to push, which beats to expand, and how to align schemes with growth targets.

3. What role do tier-2 and tier-3 cities play in my New Year plan?

Tier-2 and tier-3 markets are witnessing strong consumption growth and evolving snacking behaviour. For distributors, these regions offer opportunities to increase numeric distribution, widen product assortment, and build long-term retailer partnerships with rising demand potential.

4. How does Priniti Foods help reduce risk in my portfolio?

Priniti Foods operates in everyday snacking categories that generate consistent repeat demand across channels. With high-rotation namkeen and savoury ranges, distributors can stabilise sales, reduce dependency on slow-moving lines, and maintain healthier working capital cycles.

5. What should I track monthly to know if my New Year plan is working?

Key metrics include active outlet count, Priniti share in overall billing, fill rates of core SKUs, average lines per invoice, and month-on-month secondary sales by beat or town. Monitoring these numbers ensures timely course correction and sustained business growth.

Get in Touch — Start Your New Year Growth Journey

Distributors who wish to explore distributorship opportunities with Priniti Foods can connect with our team to discuss territory availability and partnership requirements.

Visit our Contact Us page on the website to submit your enquiry:

https://www.prinitifoods.com/contact-us.php

You may also connect with us through our official LinkedIn page:

https://www.linkedin.com/company/prinitifoods

The blog really highlights the diversity in FMCG products and their appeal across various markets. I believe that distributors should also consider how digital platforms are enabling faster product adoption, especially in international markets.